Read the document

DownloadUpdated: January 10, 2024

Published Date: January 10, 2024

Introduction

Section PS 3160, Public Private Partnerships, was issued by the Public Sector Accounting Standards Board (PSAB or the “Board”) August 2021.

It is effective for fiscal years beginning on or after April 1, 2023 which means that March 31, 2024 and December 31, 2024 will be the first year ends impacted. Section PS 3160 applies to all public sector entities following Public Sector Accounting Standards (PSAS).

There are over 250 public private partnership (P3) projects in Canada covering a large number of capital infrastructure projects including, but not limited to highways and bridges, transit systems, water treatment facilities, hospitals, schools and post secondary institutions. This means that a large number of public sector entities may be impacted by Section PS 3160.

The standard provides an overview on how to account for and report an infrastructure asset and corresponding liability for public private partnerships. This publication will walk through a practical approach to apply Section PS 3160 including: how to determine whether an arrangement/contract may be within the scope of this standard; the criteria that need to be met to recognize an infrastructure asset and corresponding liability; measurement of the infrastructure asset and liability; disclosure; and transitional considerations.

Use the links below to navigate to the various sections of the publication.

Three Step Approach

The three steps to this approach are as follows:

Step 1: Identification

Identify items that may be within the scope of Section PS 3160.Step 2: Recognition

For each item in scope, determine if it meets the recognition criteria to record an infrastructure asset and corresponding liability.Step 3: Measurement

For each item that meets the recognition criteria, determine the appropriate measurement.Let's look at each step in more detail.

Step 1 : Identify arrangements/contracts that may be within scope of Section PS 3160

Step 1 is the most important step since if it is skipped there is the potential to scope in arrangements/contracts that are not actually within the scope of Section PS 3160. Step 1 is also important as it will help an entity identify if any other alternative financing arrangements may exist at the public sector entity that do not fall within the scope of Section PS 3160, but which still need to be recognized in the financial statements.

To know what is in scope, we first need to understand what is meant by the term public private partnership. Section PS 3160 explains that a public private partnership within the scope of this section is:

- An arrangement between a public sector entity and a private sector partner where the public sector entity procures infrastructure using a private sector partner;

- With risk allocation that provides for public sector control of the asset at any point during the arrangement; and

- Where the private sector entity is obligated to do all of the following:

- Design, build, acquire or better new or existing infrastructure;

- Finance the transaction past the point where the infrastructure is ready for use; and

- Operation and/or maintain the infrastructure.

The following is a list of common types of arrangements that are often referred to as “public private partnerships (P3s)”.

Types of arrangements in scope of Section PS 3160

Public sector entity contracts with private sector partner to design, finance, construct and operate infrastructure for a specified time.

During that time, the private sector owns and operates the infrastructure earning a return on investment through a lease arrangement with the public sector entity or through user charges.

At the end of the period, the public sector entity takes possession of the facility and has the option of running the facility itself or giving another contract to the original private sector partner or another corporation.

Types of arrangements NOT in scope of Section PS 3160

Public sector entity contracts with private sector partner to design, finance and build infrastructure which it then leases to the public sector. Public sector entity makes lease payments to private sector partner.

At the end of the lease term, public sector entity may re-lease infrastructure or purchase it.

Private sector partner has no obligation to operate or maintain the infrastructure as the lessor.

While the above types of arrangements may all be referred to as public private partnerships (P3s), not all of these arrangements will meet the criteria listed earlier to be considered within scope of Section PS 3160.

Even if an arrangement does not fall into Section PS 3160, there is potential that the arrangement could be another type of alternative financing arrangement with assets and liabilities that need to be recognized under a different section of PSAS. It is critical to understand the types of arrangements that public sector entities engage in, as well as understand which sections of PSAS these arrangements are accounted for under.

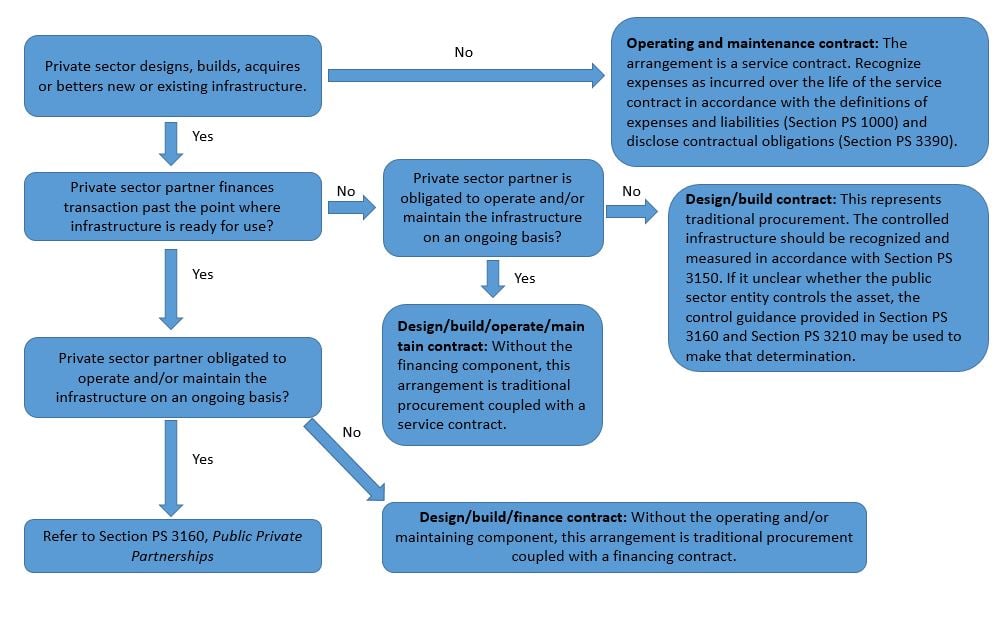

For more guidance, refer to the flow chart in Appendix A for a series of questions to consider in determining which standard applies for a given situation when considering which types of arrangements may be scoped into Section PS 3160.

The Right Team

In order to identify potential public private partnerships, it is important to put together a team of knowledgeable people from different areas of the organization including finance, public works, asset management, engineering, legal, etc., as well as, any external experts needed.

In this first step, the team's goal is to put together a complete list of all potential arrangements/contracts that could be scoped into Section PS 3160 as public private partnerships. While creating this list the team should keep in mind, the most important items to identify are those that could result in a material misstatement to the financial statements.

- Are there any known arrangements that have already been identified as a P3 that would fall into the scope of Section PS 3160? If so, how have these arrangements been treated for accounting purposes?

- Are there any arrangements that have been accounted for under PSG-2, Leases? If so, have the terms and economic substance of the arrangement been reviewed to determine if the leased infrastructure satisfies the criteria for recognition of an infrastructure assets as part of a public private partnership arrangement (note even though an arrangement may be structured as a lease, if it meets the criteria to be within the scope of and recognized under Section PS 3160 it would be accounted for under this new section)?

- What sort of capital project arrangements have been/are being engaged in? Do any of the arrangements include a private sector partner and what are the private sector partner's obligations? Who are the construction and funding partners? Who is performing the operating and maintenance functions?

- Does the organization have any arrangements with "off balance sheet" assets or liabilities?

- Are there assets which are controlled/owned by the public sector entity but not currently recorded in the records of the public sector entity?

- Review of minutes and government press releases may provide indications to arrangements/contracts that may be in scope of Section PS 3160.

Once a complete list of potential arrangements/contracts that fall within the scope of Section PS 3160 have been compiled, it is then time to determine if each arrangement meets the criteria for recognition.

Step 2 : For each item in scope, determine if it meets the recognition criteria in Section PS 3160

It is important to note that not all items that fall within the scope of Section PS 3160 will meet the recognition criteria of the standard.

Under Section PS 3160, a public sector entity recognizes an infrastructure asset/ betterment to infrastructure where through the terms and economic substance of the arrangement the public sector controls:

- The purpose and use of the infrastructure;

- Access to the future economic benefits and exposure to risks of the infrastructure asset; and

- Significant residual interest in the infrastructure, if any, at the end of the P3's term.

Further, Section PS 3160 explains that infrastructure identified in a P3 arrangement meets the definition of an asset for a public sector entity when all the criteria described below are met:

- The public sector entity expects to benefit from the use of the infrastructure to provide goods and services and is exposed to the risks;

- Through the terms of the arrangement, the public sector entity controls the infrastructure, access to the related future economic benefits, and exposure to the risks. The terms specify:

- The purpose and use of the infrastructure;

- Who may access the infrastructure;

- Its related future economic benefit; and

- Any significant residual interest in the infrastructure that exposes the public sector entity t the risks associated with the asset; and

- The signed and executed public private partnership agreement comprises the past event that gives control of the infrastructure to the public sector entity.

Understanding whether a public sector entity controls the infrastructure assets is a critical part of determining whether the recognition criteria are met.

When the conditions are met for a public sector entity to recognize an infrastructure asset it also recognizes a corresponding liability.

Step 3: For each item that meets the recognition criteria, determine the appropriate measurement

Infrastructure Asset

A constructure or acquired infrastructure asset in a public private partnership arrangement is initially measured at the public sector entity's cost (which represents fair value at the date of recognition) when cost is determinable and verifiable. When cost is neither determinable nor verifiable, the infrastructure asst is measured at fair value. Under Section PS 3160 fair value is interpreted to mean the price a market participant would pay for an equivalent infrastructure asset with the same service potential and risk profile. The standard provides further guidance on determining cost and fair value.

Subsequently, the cost, less any residual value, of an infrastructure asset with a limited life is amortized over its useful life in a rational and systematic manner appropriate to its nature and use by the public sector entity. In determining the infrastructure asset's useful life, a public sector entity would consider performance requirements that specific the asset will be maintained at specified levels throughout and at the end of the arrangement. This could result in the asset still having substantial useful life left at the end of the arrangement. As a result, the useful life of an infrastructure asset under a public private partnership may be significantly longer than the historical average for that particular asset class.

Liability

As discussed previously, when a public sector entity recognizes an infrastructure asset it also recognizes a corresponding liability. The liability is initially measured at the same amount as the related infrastructure asset, less any consideration previously provided to the private sector partner.

There are two types of consideration provided to the private sector partner.

It is possible for the private sector partner to be compensated by a combination of the above. In these circumstances, a public sector entity would be required to recognize both a financial liability and a performance obligation.

The distinction of consideration is relevant for the subsequent measurement of the liability.

Under the financial liability model, financial liabilities are subsequently measured at amortized cost using the effective interest method. This involves determining the appropriate discount rate. The discount rate that is required to be used is the rate implicit to the contract. The implicit contract rate represents the rate that reflects the financing charge in the agreement/contract. It is not just the public sector entity's cost of borrowing. If the rate implicit to the contract cannot be determined then the weighted average cost of capital specific to the P3 arrangement or the private sector partner's cost of capital is to be used. In rare cases where none of these rates can be determined, another rate that accurately reflects the financing charge embedded in the financial liability is to be used.

Under the user pay model, the performance obligation is drawn down and revenue is recognized over the period of arrangement as per the requirements of Section PS 3400, Revenue.

The public sector will also be obligated to pay the private sector partner to operate and/or maintain the infrastructure as part of the P3 arrangement. Such costs do not extend the service capacity of the asset and as a result they are expensed in a rational and systematic manner that best corresponds to the benefit received from the services being provided over the term of the service contract in a public private partnership arrangement. This represents a contractual obligation of the public sector entity that would be disclosed in accordance with Section PS 3390, Contractual Obligations.

Refer to our PSAB at a Glance Section PS 3160 – Public Private Partnerships publication for further details on the accounting requirements of this new standard.

Disclosures

Section PS 3160 contains significant disclosures for arrangements that are public private partnerships to ensure financial statement users can understand the effect of the arrangement on the entity. Some of the key items a public sector entity would need to disclose for its public private partnerships include:

- Significant terms of the arrangement that may affect the amount, timing and uncertainty of future cash flow payments;

- Key rights and obligations for the private sector partner under the arrangement;

- The accounting policy used by the public sector entity in accounting for infrastructure assets and liabilities, including the basis for any estimation techniques used; and

- Changes in the terms of the arrangement occurring during the reporting period.

Transition and Impact on Transition

Section PS 3160 comes into effect for fiscal years beginning on or after April 1, 2023 with earlier application permitted. Application of the new standard is either retroactive or prospective as follows:

- Prospectively, for an infrastructure asset and related liability where control by the public sector entity over the infrastructure asset arose after April 1, 2023.

- Retroactively with or without prior period restatement, for an infrastructure asset and related liability where control by the public sector entity over the infrastructure asset arose prior to April 1, 2023 and

- The asset and related liability has either been not previously recognized; or

- The previously recognized asset and related liability requires adjustment in applying Section PS 3160.

Existing arrangements

A public sector entity may have public private partnership arrangement that were previously recognized in the financial statements. Since there was previously no specific section on accounting for public private partnership arrangements in the PSAS Handbook, entities looked to other standards for guidance in accounting for such arrangements. Many entities may have accounted for such arrangements following the guidance in PSG-2, Leased Tangible Capital Assets, within the PSAS Handbook. Other public sector entities may have looked to the guidance in International Public Sector Accounting Standards (IPSAS) as IPSAS 32, Service Concession Arrangements, provides guidance on accounting for public private partnership arrangements.

Transition to Section PS 3160 may result in transition differences as the guidance in PSG-2 and IPSAS 32 is not the same as Section PS 3160. In general, there will likely be more differences if accounting was based on PSG-2 in the past and less differences if it was based on IPSAS 32, as the principles in IPSAS 32 are more aligned with Section PS 3160.

| Key difference | PSG-2, Leased Capital Assets | IPSAS 32, Service Concession Arrangements | PS 3160, Public Private Partnerships |

|---|---|---|---|

| Recognition | Recognition of a leased tangible capital asset and the related lease liability is based on transfer of benefits and risks as set out in PSG-2. | Recognition of a service concession asset and a related liability is based on the public sector entity obtaining control under the criteria set out in IPSAS 32. | Recognition of an infrastructure asset and a related liability is based on the public sector entity obtaining control under the criteria set out in PS 3160. |

| Initial Measurement | Initial measurement of the leased tangible capital asset and related liability is at the present value of the minimum lease payments, excluding executory costs. | Initial measurement of the service concession asset is at fair value. The corresponding liability is measured at the same amount adjusted for any previously provided consideration. | Initial measurement of the infrastructure asset is at cost (which represents fair value (as defined in PS 3160) at the date of recognition), or fair value when cost is neither determinable nor verifiable. The corresponding liability is measured at the same amount less any previously provided consideration. |

| Subsequent Measurement | The leased tangible capital asst is amortized over the period of expected use. If the lease contains a bargain purchase option or ownership terms then it's amortized over the asset's economic life. Otherwise, it's amortized over the lease term. | The service concession asset is amortized over its useful life. How the liability is subsequently measured depends on which model it falls under:

| The infrastructure asset is amortized over its useful life. How the liability is subsequently measured depends on which model it falls under:

|

| Discount Rate | The discount rate is the lower of the public sector entity's incremental borrowing rate and the rate implicit in the lease contract as outlined in PSG-2. | Under IPSAS 32 the discount rate under the financial liability model for subsequent measurement is the operator's cost of capital unless not determinable. If the operators cost of capital is not determinable, the rate implicit to the contract is required, or the public sector entity's incremental borrowing rate, or another rate appropriate to the terms and conditions of the arrangement. | Applies to the financial liability model for subsequent measurement. The discount rate is the rate implicit to the contract, but if that cannot be determined than it is the weighted average cost of capital specific to the P3 arrangement or the private sector partner's cost of capital. In rare cases where none of the above can be determined it is another rate that accurately reflects the financing charge embedded in the financial liability model. |

| Disclosures | A number of disclosures required. | Extensive disclosures required. | Extensive disclosures required. Significantly more than those required by PSG-2. More similar to IPSAS 32 requirements, but there are additional requirements under PS 3160. |

It is important to note that the table above does not highlight all the differences that may exist upon transition. The table only summarizes some of the key differences. Additionally, each arrangement is unique and may contain clauses that have different impacts on the accounting.

Other considerations

Applying Section PS 3160 can be complex. As a result, there are some other considerations and tips that may be useful to keep in mind as your organization begins its journey in applying this section.

- There may be multiple lengthy agreements that form the arrangement and span long periods of time. All agreements should be obtained and read together to fully understand the arrangement.

- Certain agreements/contracts may not include the actual cost of the infrastructure assets. In this case the cost or fair value of the infrastructure asset must be estimated. This process may require experts and others with relevant knowledge outside the team (i.e., independent appraiser, quotes or estimates).

- Some agreements/contracts may not include a discount rate (implicit contract rate). As a result, an alternative rate as discussed previously must be determined which can be complex.

- Some agreements contain both a capital and operating/maintenance component. In this case the predetermined service payments must be separated and allocated between the capital portion related to the cost of the infrastructure and the operating/maintenance portion.

- Previously recognized P3 arrangements may involve an adjustment upon transition to Section PS 3160 and will likely require additional disclosures as the previous guidance entities typically followed in accounting for public private partnerships was not exactly the same as the guidance in Section PS 3160.

This publication highlights key items to consider in applying new Section PS 3160, but it is not a comprehensive list of all the considerations and guidance in the standard. Public private partnership arrangements are unique and complex. Each arrangement should be analyzed carefully to understand the full impact of the adoption of Section PS 3160. If you have not already, we encourage you to start preparing for the application of Section PS 3160 and to consult with your assurance provider early in the process to help resolve any challenges encountered.

Conclusion

Applying Section PS 3160 can be complex to apply, but by assembling the right team and considering the steps in this publication, the standard can be applied in an efficient manner. If you have questions on how this standard affects your entity or require assistance in undertaking the application of Section PS 3160, reach out to a BDO advisor today to find out the options available to your organization for support.

Appendix A - Determine which Section Applies

The following flowchart can be used to help determine which standard an entity should look to for guidance in accounting for public private partnerships or other alternative financing arrangements.

The information in this publication is current as of January 10, 2024.

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact BDO Canada LLP to discuss these matters in the context of your particular circumstances. BDO Canada LLP, its partners, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it. BDO Canada LLP, a Canadian limited liability partnership, is a member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. BDO is the brand name for the BDO network and for each of the BDO Member Firms.